Classifying Risky P2P Loans¶

Abstract¶

The prevalence of a global Peer-to-Peer (P2P) economy, coupled with the recent deregulation of financial markets, has lead to the widespread adoption of Artificial Intelligence driven by FinTech firms to manage risk when speculating on unsecured P2P debt obligations. After meticulously identifying ‘debt belonging to high-risk individuals’ by leveraging an ensemble of Machine Learning algorithms, these firms are able to find ideal trading opportunities.

While researching AI-driven portfolio management that favor risk-minimization strategies by unmasking subtle interactions amongst high dimensional features to identify prospective trades that exhibit modest ,low-risk gains, I was impressed that the overall portfolio: realized a modest return through a numerosity of individual gains; achieved an impressive Sharpe ratio stemming from infrequent losses and minimal portfolio volatility.

Project Overview¶

Objective¶

Build a binary classification model that predicts the “Charged Off” or “Fully Paid” Status of a loan by analyzing predominant characteristics which differentiate the two classes in order to engineer new features that may better enable our Machine Learning algorithms to reach efficacy in minimizing portfolio risk while observing better-than-average returns. Ultimately, the aim is to deploy this model to assist in placing trades on loans immediately after they are issued by Lending Club.

About P2P Lending¶

Peer-to-Peer (P2P) lending offers borrowers with bad credit to get the necessary funds to meet emergency deadlines. It might seem careless to lend even more money to people who have demonstrated an inability to repay loans in the past. However, by implementing Machine Learning algorithms to classify poor trade prospects, one can effectively minimize portfolio risk.

There is a large social component to P2P lending, for sociological factors (stigma of defaulting) often plays a greater role than financial metrics in determining an applicant’s creditworthiness. For example the “online friendships of borrowers act as signals of credit quality.” ( Lin et all, 2012)

The social benefit of providing finance for another individual has wonderful implications, and, while it is nice to engage in philanthropic activities, the motivating factor for underwriting speculating in p2p lending markets is financial gain, especially since the underlying debt is unsecured and investors are liable to defaults.

Project Setup¶

Import Libraries & Modules¶

from IPython.display import display

from IPython.core.display import HTML

import warnings

warnings.filterwarnings('ignore')

import os

if os.getcwd().split('/')[-1] == 'notebooks':

os.chdir('../')

import pandas as pd

import numpy as np

import matplotlib

import matplotlib.pyplot as plt

import seaborn as sns

import pandas_profiling

from sklearn.model_selection import GridSearchCV

from sklearn.model_selection import StratifiedShuffleSplit

from sklearn.model_selection import train_test_split

from sklearn.pipeline import Pipeline

from sklearn.preprocessing import Imputer

from sklearn.dummy import DummyClassifier

from sklearn.ensemble import AdaBoostClassifier

from sklearn.ensemble import ExtraTreesClassifier

from sklearn.ensemble import GradientBoostingClassifier

from sklearn.ensemble import RandomForestClassifier

from sklearn.tree import DecisionTreeClassifier

# written by Gilles Louppe and distributed under the BSD 3 clause

from src.vn_datasci.blagging import BlaggingClassifier

from sklearn.metrics import accuracy_score

from sklearn.metrics import classification_report

from sklearn.metrics import fbeta_score

from sklearn.metrics import make_scorer

from sklearn.metrics import roc_auc_score

from sklearn.metrics import roc_curve

from sklearn.metrics import classification_report

# self-authored library that to facilatate ML classification and evaluation

from src.vn_datasci.skhelper import LearningModel, eval_db

Notebook Config¶

from IPython.display import display

from IPython.core.display import HTML

import warnings

warnings.filterwarnings('ignore')

import os

if os.getcwd().split('/')[-1] == 'notebooks':

os.chdir('../')

%matplotlib inline

#%config figure_format='retina'

plt.rcParams.update({'figure.figsize': (10, 7)})

sns.set_context("notebook", font_scale=1.75, rc={"lines.linewidth": 1.25})

sns.set_style("darkgrid")

sns.set_palette("deep")

pd.options.display.width = 80

pd.options.display.max_columns = 50

pd.options.display.max_rows = 50

Data Preprocessing¶

Load Dataset¶

Data used for this project comes directly from Lending Club’s historical loan records (the full record contains more than 100 columns).

def load_dataset(path='data/raw/lc_historical.csv'):

lc = pd.read_csv(path, index_col='id', memory_map=True, low_memory=False)

lc.loan_status = pd.Categorical(lc.loan_status, categories=['Fully Paid', 'Charged Off'])

return lc

dataset = load_dataset()

Exploration¶

Summary¶

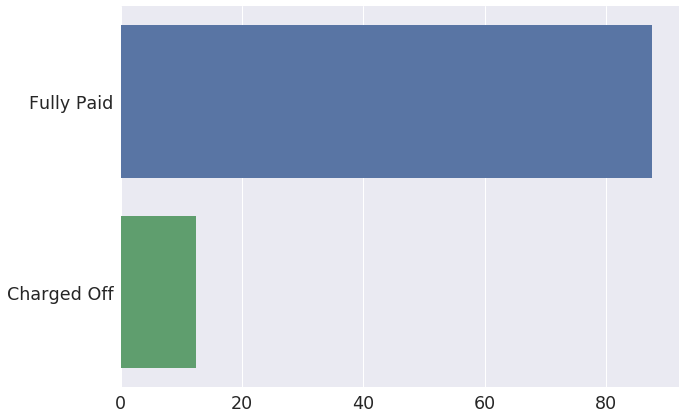

Target: loan-status

Number of features: 18

Number of observations: 138196

Feature datatypes:

object: dti, bc_util, fico_range_low, percent_bc_gt_75, acc_open_past_24mths, annual_inc, recoveries, avg_cur_bal, loan_amnt

float64: revol_util, earliest_cr_line, purpose, emp_length, home_ownership, addr_state, issue_d, loan_status

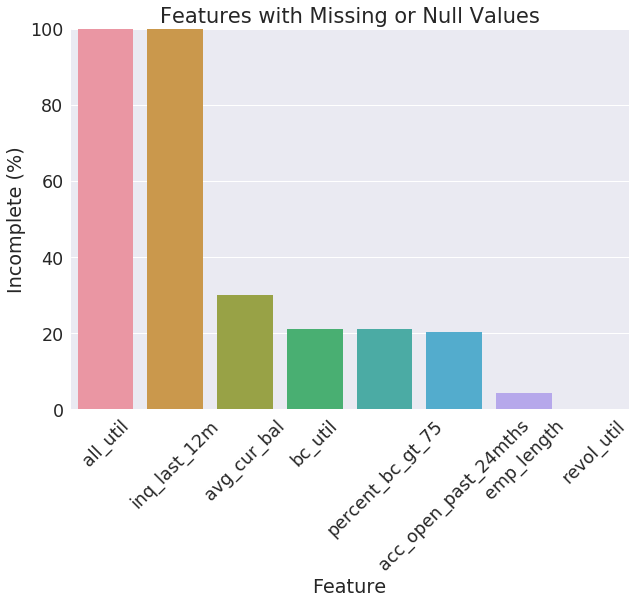

Features with ALL missing or null values:

inq_last_12m

all_util

Features with SOME missing or null values:

avg_cur_bal (30%)

bc_util (21%)

percent_bc_gt_75 (21%)

acc_open_past_24mths (20%)

emp_length (0.18%)

revol_util (0.08%)

Missing Data¶

Helper Functions¶

def calc_incomplete_stats(dataset):

warnings.filterwarnings("ignore", 'This pattern has match groups')

missing_data = pd.DataFrame(index=dataset.columns)

missing_data['Null'] = dataset.isnull().sum()

missing_data['NA_or_Missing'] = (

dataset.apply(lambda col: (

col.str.contains('(^$|n/a|^na$|^%$)', case=False).sum()))

.fillna(0).astype(int))

missing_data['Incomplete'] = (

(missing_data.Null + missing_data.NA_or_Missing) / len(dataset))

incomplete_stats = ((missing_data[(missing_data > 0).any(axis=1)])

.sort_values('Incomplete', ascending=False))

return incomplete_stats

def display_incomplete_stats(incomplete_stats):

stats = incomplete_stats.copy()

df_incomplete = (

stats.style

.set_caption('Missing')

.background_gradient(cmap=sns.light_palette("orange", as_cmap=True),

low=0, high=1, subset=['Null', 'NA_or_Missing'])

.background_gradient(cmap=sns.light_palette("red", as_cmap=True),

low=0, high=.6, subset=['Incomplete'])

.format({'Null': '{:,}', 'NA_or_Missing': '{:,}', 'Incomplete': '{:.1%}'}))

display(df_incomplete)

def plot_incomplete_stats(incomplete_stats, ylim_range=(0, 100)):

stats = incomplete_stats.copy()

stats.Incomplete = stats.Incomplete * 100

_ = sns.barplot(x=stats.index.tolist(), y=stats.Incomplete.tolist())

for item in _.get_xticklabels():

item.set_rotation(45)

_.set(xlabel='Feature', ylabel='Incomplete (%)',

title='Features with Missing or Null Values',

ylim=ylim_range)

plt.show()

def incomplete_data_report(dataset, display_stats=True, plot=True):

incomplete_stats = calc_incomplete_stats(dataset)

if display_stats:

display_incomplete_stats(incomplete_stats)

if plot:

plot_incomplete_stats(incomplete_stats)

incomplete_stats = load_dataset().pipe(calc_incomplete_stats)

display(incomplete_stats)

| Null | NA_or_Missing | Incomplete | |

|---|---|---|---|

| all_util | 172745 | 0 | 1.000000 |

| inq_last_12m | 172745 | 0 | 1.000000 |

| avg_cur_bal | 51649 | 0 | 0.298990 |

| bc_util | 36407 | 0 | 0.210756 |

| percent_bc_gt_75 | 36346 | 0 | 0.210403 |

| acc_open_past_24mths | 35121 | 0 | 0.203311 |

| emp_length | 0 | 7507 | 0.043457 |

| revol_util | 144 | 0 | 0.000834 |

plot_incomplete_stats(incomplete_stats)

Data Munging¶

Cleaning¶

all_util, inq_last_12m

Drop features (all observations contain null/missing values)

revol_util

Remove the percent sign (%) from string

Convert to a float

earliest_cr_line, issue_d

Convert to datetime data type.

emp_length

Strip leading and trailing whitespace

Replace ‘< 1’ with ‘0.5’

Replace ‘10+’ with ‘10.5’

Fill null values with ‘-1.5’

Convert to float

def clean_data(lc):

lc = lc.copy().dropna(axis=1, thresh=1)

dt_features = ['earliest_cr_line', 'issue_d']

lc[dt_features] = lc[dt_features].apply(

lambda col: pd.to_datetime(col, format='%Y-%m-%d'), axis=0)

cat_features =['purpose', 'home_ownership', 'addr_state']

lc[cat_features] = lc[cat_features].apply(pd.Categorical, axis=0)

lc.revol_util = (lc.revol_util

.str.extract('(\d+\.?\d?)', expand=False)

.astype('float'))

lc.emp_length = (lc.emp_length

.str.extract('(< 1|10\+|\d+)', expand=False)

.replace('< 1', '0.5')

.replace('10+', '10.5')

.fillna('-1.5')

.astype('float'))

return lc

dataset = load_dataset().pipe(clean_data)

Feature Engineering¶

New Features¶

loan_amnt_to_inc

the ratio of loan amount to annual income

earliest_cr_line_age

age of first credit line from when the loan was issued

avg_cur_bal_to_inc

the ratio of avg current balance to annual income

avg_cur_bal_to_loan_amnt

the ratio of avg current balance to loan amount

acc_open_past_24mths_groups

level of accounts opened in the last 2 yrs

def add_features(lc):

# ratio of loan amount to annual income

group_labels = ['low', 'avg', 'high']

lc['loan_amnt_to_inc'] = (

pd.cut((lc.loan_amnt / lc.annual_inc), 3, labels=['low', 'avg', 'high'])

.cat.set_categories(['low', 'avg', 'high'], ordered=True))

# age of first credit line from when the loan was issued

lc['earliest_cr_line_age'] = (lc.issue_d - lc.earliest_cr_line).astype(int)

# the ratio of avg current balance to annual income

lc['avg_cur_bal_to_inc'] = lc.avg_cur_bal / lc.annual_inc

# the ratio of avg current balance to loan amount

lc['avg_cur_bal_to_loan_amnt'] = lc.avg_cur_bal / lc.loan_amnt

# grouping level of accounts opened in the last 2 yrs

lc['acc_open_past_24mths_groups'] = (

pd.qcut(lc.acc_open_past_24mths, 3, labels=['low', 'avg', 'high'])

.cat.add_categories(['unknown']).fillna('unknown')

.cat.set_categories(['low', 'avg', 'high', 'unknown'], ordered=True))

return lc

dataset = load_dataset().pipe(clean_data).pipe(add_features)

Drop Features¶

def drop_features(lc):

target_leaks = ['recoveries', 'issue_d']

other_features = ['earliest_cr_line', 'acc_open_past_24mths', 'addr_state']

to_drop = target_leaks + other_features

return lc.drop(to_drop, axis=1)

dataset = load_dataset().pipe(clean_data).pipe(add_features).pipe(drop_features)

Load & Prepare Function¶

def load_and_preprocess_data():

return (load_dataset()

.pipe(clean_data)

.pipe(add_features)

.pipe(drop_features))

Exploratory Data Analysis (EDA)¶

Helper Functions¶

def plot_factor_pct(dataset, feature):

if feature not in dataset.columns:

return

y = dataset[feature]

factor_counts = y.value_counts()

x_vals = factor_counts.index.tolist()

y_vals = ((factor_counts.values/factor_counts.values.sum())*100).round(2)

sns.barplot(y=x_vals, x=y_vals);

def plot_pct_charged_off(lc, feature):

lc_counts = lc[feature].value_counts()

charged_off = lc[lc.loan_status=='Charged Off']

charged_off_counts = charged_off[feature].value_counts()

charged_off_ratio = ((charged_off_counts / lc_counts * 100)

.round(2).sort_values(ascending=False))

x_vals = charged_off_ratio.index.tolist()

y_vals = charged_off_ratio

sns.barplot(y=x_vals, x=y_vals);

Overview¶

Missing Data¶

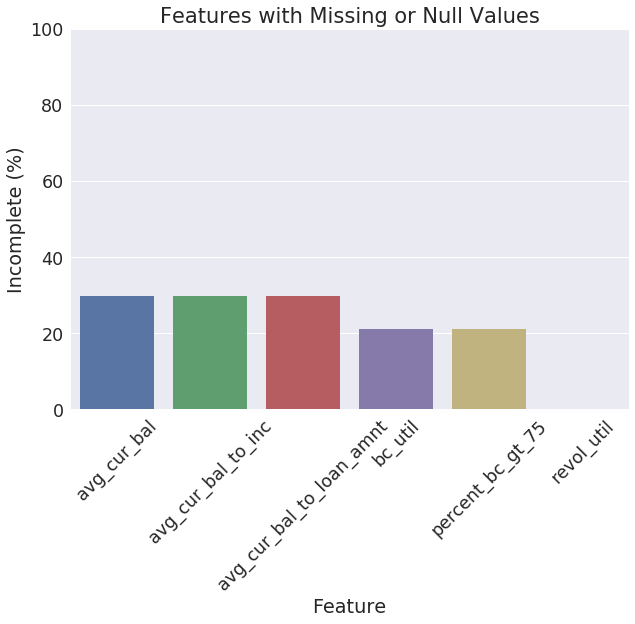

processed_dataset = load_and_preprocess_data()

incomplete_stats = calc_incomplete_stats(processed_dataset)

display(incomplete_stats)

| Null | NA_or_Missing | Incomplete | |

|---|---|---|---|

| avg_cur_bal | 51649 | 0 | 0.298990 |

| avg_cur_bal_to_inc | 51649 | 0 | 0.298990 |

| avg_cur_bal_to_loan_amnt | 51649 | 0 | 0.298990 |

| bc_util | 36407 | 0 | 0.210756 |

| percent_bc_gt_75 | 36346 | 0 | 0.210403 |

| revol_util | 144 | 0 | 0.000834 |

plot_incomplete_stats(incomplete_stats)

Summary Statistics¶

HTML(processed_dataset.pipe(pandas_profiling.ProfileReport).html)

Overview

Dataset info

| Number of variables | 18 |

|---|---|

| Number of observations | 172745 |

| Total Missing (%) | 7.3% |

| Total size in memory | 18.0 MiB |

| Average record size in memory | 109.0 B |

Variables types

| Numeric | 13 |

|---|---|

| Categorical | 5 |

| Date | 0 |

| Text (Unique) | 0 |

| Rejected | 0 |

Warnings

annual_incis highly skewed (γ1 = 35.012)avg_cur_balhas 51649 / 29.9% missing values Missingavg_cur_bal_to_inchas 51649 / 29.9% missing values Missingavg_cur_bal_to_loan_amnthas 51649 / 29.9% missing values Missingbc_utilhas 36407 / 21.1% missing values Missingpercent_bc_gt_75has 21592 / 12.5% zerospercent_bc_gt_75has 36346 / 21.0% missing values Missing

Variables

acc_open_past_24mths_groups

Categorical

| Distinct count | 4 |

|---|---|

| Unique (%) | 0.0% |

| Missing (%) | 0.0% |

| Missing (n) | 0 |

| avg | |

|---|---|

| low | |

| unknown |

| Value | Count | Frequency (%) | |

| avg | 59367 | 34.4% | |

| low | 46567 | 27.0% | |

| unknown | 35121 | 20.3% | |

| high | 31690 | 18.3% |

annual_inc

Numeric

| Distinct count | 14645 |

|---|---|

| Unique (%) | 8.5% |

| Missing (%) | 0.0% |

| Missing (n) | 0 |

| Infinite (%) | 0.0% |

| Infinite (n) | 0 |

| Mean | 69396 |

|---|---|

| Minimum | 4000 |

| Maximum | 7141800 |

| Zeros (%) | 0.0% |

Quantile statistics

| Minimum | 4000 |

|---|---|

| 5-th percentile | 25500 |

| Q1 | 42000 |

| Median | 60000 |

| Q3 | 84450 |

| 95-th percentile | 141000 |

| Maximum | 7141800 |

| Range | 7137800 |

| Interquartile range | 42450 |

Descriptive statistics

| Standard deviation | 55278 |

|---|---|

| Coef of variation | 0.79657 |

| Kurtosis | 3573.1 |

| Mean | 69396 |

| MAD | 29465 |

| Skewness | 35.012 |

| Sum | 11988000000 |

| Variance | 3055700000 |

| Memory size | 1.3 MiB |

| Value | Count | Frequency (%) | |

| 60000.0 | 6513 | 3.8% | |

| 50000.0 | 6008 | 3.5% | |

| 40000.0 | 5135 | 3.0% | |

| 45000.0 | 4651 | 2.7% | |

| 65000.0 | 4538 | 2.6% | |

| 70000.0 | 4224 | 2.4% | |

| 75000.0 | 4035 | 2.3% | |

| 55000.0 | 3972 | 2.3% | |

| 80000.0 | 3971 | 2.3% | |

| 30000.0 | 3512 | 2.0% | |

| Other values (14635) | 126186 | 73.0% |

Minimum 5 values

| Value | Count | Frequency (%) | |

| 4000.0 | 1 | 0.0% | |

| 4080.0 | 1 | 0.0% | |

| 4200.0 | 2 | 0.0% | |

| 4800.0 | 3 | 0.0% | |

| 4888.0 | 1 | 0.0% |

Maximum 5 values

| Value | Count | Frequency (%) | |

| 2039784.0 | 1 | 0.0% | |

| 5000000.0 | 1 | 0.0% | |

| 6000000.0 | 1 | 0.0% | |

| 6100000.0 | 1 | 0.0% | |

| 7141778.0 | 1 | 0.0% |

avg_cur_bal

Numeric

| Distinct count | 36973 |

|---|---|

| Unique (%) | 30.5% |

| Missing (%) | 29.9% |

| Missing (n) | 51649 |

| Infinite (%) | 0.0% |

| Infinite (n) | 0 |

| Mean | 12920 |

|---|---|

| Minimum | 0 |

| Maximum | 958080 |

| Zeros (%) | 0.0% |

Quantile statistics

| Minimum | 0 |

|---|---|

| 5-th percentile | 1041 |

| Q1 | 2692 |

| Median | 6441 |

| Q3 | 18246 |

| 95-th percentile | 42192 |

| Maximum | 958080 |

| Range | 958080 |

| Interquartile range | 15554 |

Descriptive statistics

| Standard deviation | 16414 |

|---|---|

| Coef of variation | 1.2704 |

| Kurtosis | 170.13 |

| Mean | 12920 |

| MAD | 11074 |

| Skewness | 6.0427 |

| Sum | 1564600000 |

| Variance | 269430000 |

| Memory size | 1.3 MiB |

| Value | Count | Frequency (%) | |

| 1250.0 | 28 | 0.0% | |

| 2352.0 | 27 | 0.0% | |

| 2120.0 | 27 | 0.0% | |

| 2589.0 | 27 | 0.0% | |

| 0.0 | 26 | 0.0% | |

| 1583.0 | 26 | 0.0% | |

| 1336.0 | 26 | 0.0% | |

| 2587.0 | 26 | 0.0% | |

| 1971.0 | 26 | 0.0% | |

| 1724.0 | 26 | 0.0% | |

| Other values (36962) | 120831 | 69.9% | |

| (Missing) | 51649 | 29.9% |

Minimum 5 values

| Value | Count | Frequency (%) | |

| 0.0 | 26 | 0.0% | |

| 1.0 | 1 | 0.0% | |

| 2.0 | 1 | 0.0% | |

| 3.0 | 1 | 0.0% | |

| 4.0 | 2 | 0.0% |

Maximum 5 values

| Value | Count | Frequency (%) | |

| 383983.0 | 1 | 0.0% | |

| 477255.0 | 1 | 0.0% | |

| 502002.0 | 1 | 0.0% | |

| 800008.0 | 1 | 0.0% | |

| 958084.0 | 1 | 0.0% |

avg_cur_bal_to_inc

Numeric

| Distinct count | 103048 |

|---|---|

| Unique (%) | 85.1% |

| Missing (%) | 29.9% |

| Missing (n) | 51649 |

| Infinite (%) | 0.0% |

| Infinite (n) | 0 |

| Mean | 0.18212 |

|---|---|

| Minimum | 0 |

| Maximum | 6.3872 |

| Zeros (%) | 0.0% |

Quantile statistics

| Minimum | 0 |

|---|---|

| 5-th percentile | 0.020754 |

| Q1 | 0.050874 |

| Median | 0.11024 |

| Q3 | 0.2552 |

| 95-th percentile | 0.55037 |

| Maximum | 6.3872 |

| Range | 6.3872 |

| Interquartile range | 0.20432 |

Descriptive statistics

| Standard deviation | 0.19319 |

|---|---|

| Coef of variation | 1.0608 |

| Kurtosis | 21.742 |

| Mean | 0.18212 |

| MAD | 0.13916 |

| Skewness | 2.8321 |

| Sum | 22054 |

| Variance | 0.037321 |

| Memory size | 1.3 MiB |

| Value | Count | Frequency (%) | |

| 0.0 | 26 | 0.0% | |

| 0.041 | 21 | 0.0% | |

| 0.045 | 20 | 0.0% | |

| 0.044 | 19 | 0.0% | |

| 0.075 | 19 | 0.0% | |

| 0.05 | 18 | 0.0% | |

| 0.054 | 17 | 0.0% | |

| 0.042 | 17 | 0.0% | |

| 0.034 | 17 | 0.0% | |

| 0.06 | 17 | 0.0% | |

| Other values (103037) | 120905 | 70.0% | |

| (Missing) | 51649 | 29.9% |

Minimum 5 values

| Value | Count | Frequency (%) | |

| 0.0 | 26 | 0.0% | |

| 2.77777777778e-05 | 1 | 0.0% | |

| 4.44444444444e-05 | 1 | 0.0% | |

| 4.7619047619e-05 | 1 | 0.0% | |

| 0.000120481927711 | 1 | 0.0% |

Maximum 5 values

| Value | Count | Frequency (%) | |

| 3.19985833333 | 1 | 0.0% | |

| 3.36695 | 1 | 0.0% | |

| 3.5543 | 1 | 0.0% | |

| 3.68520833333 | 1 | 0.0% | |

| 6.38722666667 | 1 | 0.0% |

avg_cur_bal_to_loan_amnt

Numeric

| Distinct count | 95901 |

|---|---|

| Unique (%) | 79.2% |

| Missing (%) | 29.9% |

| Missing (n) | 51649 |

| Infinite (%) | 0.0% |

| Infinite (n) | 0 |

| Mean | 1.374 |

|---|---|

| Minimum | 0 |

| Maximum | 172.55 |

| Zeros (%) | 0.0% |

Quantile statistics

| Minimum | 0 |

|---|---|

| 5-th percentile | 0.10397 |

| Q1 | 0.2542 |

| Median | 0.62682 |

| Q3 | 1.5551 |

| 95-th percentile | 4.7668 |

| Maximum | 172.55 |

| Range | 172.55 |

| Interquartile range | 1.3009 |

Descriptive statistics

| Standard deviation | 2.574 |

|---|---|

| Coef of variation | 1.8734 |

| Kurtosis | 337.31 |

| Mean | 1.374 |

| MAD | 1.2728 |

| Skewness | 11.39 |

| Sum | 166380 |

| Variance | 6.6256 |

| Memory size | 1.3 MiB |

| Value | Count | Frequency (%) | |

| 0.0 | 26 | 0.0% | |

| 0.28 | 22 | 0.0% | |

| 0.16 | 21 | 0.0% | |

| 0.18 | 18 | 0.0% | |

| 0.196 | 18 | 0.0% | |

| 0.32 | 17 | 0.0% | |

| 0.15 | 17 | 0.0% | |

| 0.3 | 16 | 0.0% | |

| 0.14 | 16 | 0.0% | |

| 0.384 | 16 | 0.0% | |

| Other values (95890) | 120909 | 70.0% | |

| (Missing) | 51649 | 29.9% |

Minimum 5 values

| Value | Count | Frequency (%) | |

| 0.0 | 26 | 0.0% | |

| 0.000129032258065 | 1 | 0.0% | |

| 0.000182648401826 | 1 | 0.0% | |

| 0.000347826086957 | 1 | 0.0% | |

| 0.000444444444444 | 1 | 0.0% |

Maximum 5 values

| Value | Count | Frequency (%) | |

| 88.445 | 1 | 0.0% | |

| 90.194 | 1 | 0.0% | |

| 101.27 | 1 | 0.0% | |

| 108.851 | 1 | 0.0% | |

| 172.548 | 1 | 0.0% |

bc_util

Numeric

| Distinct count | 1178 |

|---|---|

| Unique (%) | 0.9% |

| Missing (%) | 21.1% |

| Missing (n) | 36407 |

| Infinite (%) | 0.0% |

| Infinite (n) | 0 |

| Mean | 66.058 |

|---|---|

| Minimum | 0 |

| Maximum | 339.6 |

| Zeros (%) | 0.7% |

Quantile statistics

| Minimum | 0 |

|---|---|

| 5-th percentile | 14.4 |

| Q1 | 48.2 |

| Median | 71.3 |

| Q3 | 88.5 |

| 95-th percentile | 98.4 |

| Maximum | 339.6 |

| Range | 339.6 |

| Interquartile range | 40.3 |

Descriptive statistics

| Standard deviation | 26.359 |

|---|---|

| Coef of variation | 0.39902 |

| Kurtosis | -0.37079 |

| Mean | 66.058 |

| MAD | 21.95 |

| Skewness | -0.65476 |

| Sum | 9006300 |

| Variance | 694.79 |

| Memory size | 1.3 MiB |

| Value | Count | Frequency (%) | |

| 0.0 | 1153 | 0.7% | |

| 98.2 | 350 | 0.2% | |

| 97.4 | 349 | 0.2% | |

| 97.9 | 347 | 0.2% | |

| 98.6 | 340 | 0.2% | |

| 96.8 | 337 | 0.2% | |

| 98.3 | 332 | 0.2% | |

| 97.5 | 331 | 0.2% | |

| 97.3 | 329 | 0.2% | |

| 97.7 | 325 | 0.2% | |

| Other values (1167) | 132145 | 76.5% | |

| (Missing) | 36407 | 21.1% |

Minimum 5 values

| Value | Count | Frequency (%) | |

| 0.0 | 1153 | 0.7% | |

| 0.1 | 81 | 0.0% | |

| 0.2 | 67 | 0.0% | |

| 0.3 | 61 | 0.0% | |

| 0.4 | 53 | 0.0% |

Maximum 5 values

| Value | Count | Frequency (%) | |

| 165.7 | 1 | 0.0% | |

| 173.2 | 1 | 0.0% | |

| 182.5 | 1 | 0.0% | |

| 187.9 | 1 | 0.0% | |

| 339.6 | 1 | 0.0% |

dti

Numeric

| Distinct count | 3499 |

|---|---|

| Unique (%) | 2.0% |

| Missing (%) | 0.0% |

| Missing (n) | 0 |

| Infinite (%) | 0.0% |

| Infinite (n) | 0 |

| Mean | 16.08 |

|---|---|

| Minimum | 0 |

| Maximum | 34.99 |

| Zeros (%) | 0.1% |

Quantile statistics

| Minimum | 0 |

|---|---|

| 5-th percentile | 4.08 |

| Q1 | 10.34 |

| Median | 15.74 |

| Q3 | 21.52 |

| 95-th percentile | 29.28 |

| Maximum | 34.99 |

| Range | 34.99 |

| Interquartile range | 11.18 |

Descriptive statistics

| Standard deviation | 7.6032 |

|---|---|

| Coef of variation | 0.47285 |

| Kurtosis | -0.60719 |

| Mean | 16.08 |

| MAD | 6.2649 |

| Skewness | 0.17839 |

| Sum | 2777700 |

| Variance | 57.809 |

| Memory size | 1.3 MiB |

| Value | Count | Frequency (%) | |

| 0.0 | 220 | 0.1% | |

| 14.4 | 186 | 0.1% | |

| 16.8 | 153 | 0.1% | |

| 12.0 | 152 | 0.1% | |

| 18.0 | 143 | 0.1% | |

| 19.2 | 139 | 0.1% | |

| 20.4 | 138 | 0.1% | |

| 15.6 | 137 | 0.1% | |

| 13.2 | 137 | 0.1% | |

| 21.6 | 130 | 0.1% | |

| Other values (3489) | 171210 | 99.1% |

Minimum 5 values

| Value | Count | Frequency (%) | |

| 0.0 | 220 | 0.1% | |

| 0.01 | 6 | 0.0% | |

| 0.02 | 6 | 0.0% | |

| 0.03 | 3 | 0.0% | |

| 0.04 | 4 | 0.0% |

Maximum 5 values

| Value | Count | Frequency (%) | |

| 34.95 | 11 | 0.0% | |

| 34.96 | 9 | 0.0% | |

| 34.97 | 7 | 0.0% | |

| 34.98 | 13 | 0.0% | |

| 34.99 | 9 | 0.0% |

earliest_cr_line_age

Numeric

| Distinct count | 2173 |

|---|---|

| Unique (%) | 1.3% |

| Missing (%) | 0.0% |

| Missing (n) | 0 |

| Infinite (%) | 0.0% |

| Infinite (n) | 0 |

| Mean | 4.7171e+17 |

|---|---|

| Minimum | 94608000000000000 |

| Maximum | 2064268800000000000 |

| Zeros (%) | 0.0% |

Quantile statistics

| Minimum | 94608000000000000 |

|---|---|

| 5-th percentile | 1.7876e+17 |

| Q1 | 3.2072e+17 |

| Median | 4.2863e+17 |

| Q3 | 5.813e+17 |

| 95-th percentile | 9.0729e+17 |

| Maximum | 2064268800000000000 |

| Range | 1969660800000000000 |

| Interquartile range | 2.6058e+17 |

Descriptive statistics

| Standard deviation | 2.2491e+17 |

|---|---|

| Coef of variation | 0.4768 |

| Kurtosis | 1.7574 |

| Mean | 4.7171e+17 |

| MAD | 1.7187e+17 |

| Skewness | 1.1264 |

| Sum | 6909064824910512128 |

| Variance | 5.0585e+34 |

| Memory size | 1.3 MiB |

| Value | Count | Frequency (%) | |

| 378691200000000000 | 1085 | 0.6% | |

| 347155200000000000 | 866 | 0.5% | |

| 373420800000000000 | 846 | 0.5% | |

| 441849600000000000 | 821 | 0.5% | |

| 410227200000000000 | 782 | 0.5% | |

| 383961600000000000 | 749 | 0.4% | |

| 473385600000000000 | 737 | 0.4% | |

| 386640000000000000 | 732 | 0.4% | |

| 381369600000000000 | 706 | 0.4% | |

| 504921600000000000 | 694 | 0.4% | |

| Other values (2163) | 164727 | 95.4% |

Minimum 5 values

| Value | Count | Frequency (%) | |

| 94608000000000000 | 4 | 0.0% | |

| 94694400000000000 | 17 | 0.0% | |

| 97113600000000000 | 5 | 0.0% | |

| 97200000000000000 | 7 | 0.0% | |

| 97286400000000000 | 49 | 0.0% |

Maximum 5 values

| Value | Count | Frequency (%) | |

| 1838246400000000000 | 1 | 0.0% | |

| 1888185600000000000 | 1 | 0.0% | |

| 1930435200000000000 | 1 | 0.0% | |

| 1972252800000000000 | 1 | 0.0% | |

| 2064268800000000000 | 1 | 0.0% |

emp_length

Numeric

| Distinct count | 12 |

|---|---|

| Unique (%) | 0.0% |

| Missing (%) | 0.0% |

| Missing (n) | 0 |

| Infinite (%) | 0.0% |

| Infinite (n) | 0 |

| Mean | 5.5865 |

|---|---|

| Minimum | -1.5 |

| Maximum | 10.5 |

| Zeros (%) | 0.0% |

Quantile statistics

| Minimum | -1.5 |

|---|---|

| 5-th percentile | 0.5 |

| Q1 | 2 |

| Median | 5 |

| Q3 | 10.5 |

| 95-th percentile | 10.5 |

| Maximum | 10.5 |

| Range | 12 |

| Interquartile range | 8.5 |

Descriptive statistics

| Standard deviation | 3.9298 |

|---|---|

| Coef of variation | 0.70344 |

| Kurtosis | -1.37 |

| Mean | 5.5865 |

| MAD | 3.4876 |

| Skewness | -0.046929 |

| Sum | 965040 |

| Variance | 15.443 |

| Memory size | 1.3 MiB |

| Value | Count | Frequency (%) | |

| 10.5 | 49479 | 28.6% | |

| 2.0 | 16294 | 9.4% | |

| 0.5 | 14318 | 8.3% | |

| 3.0 | 14219 | 8.2% | |

| 5.0 | 13433 | 7.8% | |

| 1.0 | 11862 | 6.9% | |

| 4.0 | 11162 | 6.5% | |

| 6.0 | 10784 | 6.2% | |

| 7.0 | 9689 | 5.6% | |

| 8.0 | 7819 | 4.5% | |

| Other values (2) | 13686 | 7.9% |

Minimum 5 values

| Value | Count | Frequency (%) | |

| -1.5 | 7507 | 4.3% | |

| 0.5 | 14318 | 8.3% | |

| 1.0 | 11862 | 6.9% | |

| 2.0 | 16294 | 9.4% | |

| 3.0 | 14219 | 8.2% |

Maximum 5 values

| Value | Count | Frequency (%) | |

| 6.0 | 10784 | 6.2% | |

| 7.0 | 9689 | 5.6% | |

| 8.0 | 7819 | 4.5% | |

| 9.0 | 6179 | 3.6% | |

| 10.5 | 49479 | 28.6% |

fico_range_low

Numeric

| Distinct count | 40 |

|---|---|

| Unique (%) | 0.0% |

| Missing (%) | 0.0% |

| Missing (n) | 0 |

| Infinite (%) | 0.0% |

| Infinite (n) | 0 |

| Mean | 699.97 |

|---|---|

| Minimum | 625 |

| Maximum | 845 |

| Zeros (%) | 0.0% |

Quantile statistics

| Minimum | 625 |

|---|---|

| 5-th percentile | 660 |

| Q1 | 675 |

| Median | 695 |

| Q3 | 715 |

| 95-th percentile | 765 |

| Maximum | 845 |

| Range | 220 |

| Interquartile range | 40 |

Descriptive statistics

| Standard deviation | 32.182 |

|---|---|

| Coef of variation | 0.045977 |

| Kurtosis | 1.1327 |

| Mean | 699.97 |

| MAD | 25.082 |

| Skewness | 1.1394 |

| Sum | 120920000 |

| Variance | 1035.7 |

| Memory size | 1.3 MiB |

| Value | Count | Frequency (%) | |

| 680.0 | 13161 | 7.6% | |

| 670.0 | 12875 | 7.5% | |

| 675.0 | 12564 | 7.3% | |

| 690.0 | 12290 | 7.1% | |

| 685.0 | 12278 | 7.1% | |

| 665.0 | 11832 | 6.8% | |

| 695.0 | 11174 | 6.5% | |

| 660.0 | 10712 | 6.2% | |

| 700.0 | 10333 | 6.0% | |

| 705.0 | 9309 | 5.4% | |

| Other values (30) | 56217 | 32.5% |

Minimum 5 values

| Value | Count | Frequency (%) | |

| 625.0 | 1 | 0.0% | |

| 630.0 | 1 | 0.0% | |

| 660.0 | 10712 | 6.2% | |

| 665.0 | 11832 | 6.8% | |

| 670.0 | 12875 | 7.5% |

Maximum 5 values

| Value | Count | Frequency (%) | |

| 825.0 | 115 | 0.1% | |

| 830.0 | 72 | 0.0% | |

| 835.0 | 26 | 0.0% | |

| 840.0 | 23 | 0.0% | |

| 845.0 | 16 | 0.0% |

home_ownership

Categorical

| Distinct count | 5 |

|---|---|

| Unique (%) | 0.0% |

| Missing (%) | 0.0% |

| Missing (n) | 0 |

| MORTGAGE | |

|---|---|

| RENT | |

| OWN | 14565 |

| Other values (2) | 175 |

| Value | Count | Frequency (%) | |

| MORTGAGE | 81081 | 46.9% | |

| RENT | 76924 | 44.5% | |

| OWN | 14565 | 8.4% | |

| OTHER | 137 | 0.1% | |

| NONE | 38 | 0.0% |

id

Numeric

| Distinct count | 172745 |

|---|---|

| Unique (%) | 100.0% |

| Missing (%) | 0.0% |

| Missing (n) | 0 |

| Infinite (%) | 0.0% |

| Infinite (n) | 0 |

| Mean | 4110500 |

|---|---|

| Minimum | 54734 |

| Maximum | 10234817 |

| Zeros (%) | 0.0% |

Quantile statistics

| Minimum | 54734 |

|---|---|

| 5-th percentile | 498350 |

| Q1 | 1339400 |

| Median | 3494800 |

| Q3 | 6636700 |

| 95-th percentile | 9175200 |

| Maximum | 10234817 |

| Range | 10180083 |

| Interquartile range | 5297200 |

Descriptive statistics

| Standard deviation | 2978800 |

|---|---|

| Coef of variation | 0.72469 |

| Kurtosis | -1.2228 |

| Mean | 4110500 |

| MAD | 2652700 |

| Skewness | 0.38567 |

| Sum | 710067252482 |

| Variance | 8873400000000 |

| Memory size | 1.3 MiB |

| Value | Count | Frequency (%) | |

| 1181780 | 1 | 0.0% | |

| 9006215 | 1 | 0.0% | |

| 9827476 | 1 | 0.0% | |

| 7720083 | 1 | 0.0% | |

| 1430672 | 1 | 0.0% | |

| 585912 | 1 | 0.0% | |

| 3488909 | 1 | 0.0% | |

| 603276 | 1 | 0.0% | |

| 904096 | 1 | 0.0% | |

| 1121417 | 1 | 0.0% | |

| Other values (172735) | 172735 | 100.0% |

Minimum 5 values

| Value | Count | Frequency (%) | |

| 54734 | 1 | 0.0% | |

| 55742 | 1 | 0.0% | |

| 57245 | 1 | 0.0% | |

| 57416 | 1 | 0.0% | |

| 58524 | 1 | 0.0% |

Maximum 5 values

| Value | Count | Frequency (%) | |

| 10234755 | 1 | 0.0% | |

| 10234796 | 1 | 0.0% | |

| 10234813 | 1 | 0.0% | |

| 10234814 | 1 | 0.0% | |

| 10234817 | 1 | 0.0% |

loan_amnt

Numeric

| Distinct count | 1183 |

|---|---|

| Unique (%) | 0.7% |

| Missing (%) | 0.0% |

| Missing (n) | 0 |

| Infinite (%) | 0.0% |

| Infinite (n) | 0 |

| Mean | 11900 |

|---|---|

| Minimum | 500 |

| Maximum | 35000 |

| Zeros (%) | 0.0% |

Quantile statistics

| Minimum | 500 |

|---|---|

| 5-th percentile | 3000 |

| Q1 | 6500 |

| Median | 10000 |

| Q3 | 15000 |

| 95-th percentile | 25500 |

| Maximum | 35000 |

| Range | 34500 |

| Interquartile range | 8500 |

Descriptive statistics

| Standard deviation | 7208.2 |

|---|---|

| Coef of variation | 0.60571 |

| Kurtosis | 0.93464 |

| Mean | 11900 |

| MAD | 5618.4 |

| Skewness | 1.0593 |

| Sum | 2055700000 |

| Variance | 51958000 |

| Memory size | 1.3 MiB |

| Value | Count | Frequency (%) | |

| 10000.0 | 14911 | 8.6% | |

| 12000.0 | 10206 | 5.9% | |

| 15000.0 | 8587 | 5.0% | |

| 8000.0 | 7382 | 4.3% | |

| 6000.0 | 6847 | 4.0% | |

| 20000.0 | 6680 | 3.9% | |

| 5000.0 | 6289 | 3.6% | |

| 16000.0 | 3712 | 2.1% | |

| 7000.0 | 3645 | 2.1% | |

| 18000.0 | 3269 | 1.9% | |

| Other values (1173) | 101217 | 58.6% |

Minimum 5 values

| Value | Count | Frequency (%) | |

| 500.0 | 5 | 0.0% | |

| 700.0 | 1 | 0.0% | |

| 725.0 | 1 | 0.0% | |

| 750.0 | 1 | 0.0% | |

| 800.0 | 1 | 0.0% |

Maximum 5 values

| Value | Count | Frequency (%) | |

| 34825.0 | 1 | 0.0% | |

| 34900.0 | 1 | 0.0% | |

| 34925.0 | 1 | 0.0% | |

| 34975.0 | 6 | 0.0% | |

| 35000.0 | 2900 | 1.7% |

loan_amnt_to_inc

Categorical

| Distinct count | 3 |

|---|---|

| Unique (%) | 0.0% |

| Missing (%) | 0.0% |

| Missing (n) | 0 |

| low | |

|---|---|

| avg | |

| high | 92 |

| Value | Count | Frequency (%) | |

| low | 135514 | 78.4% | |

| avg | 37139 | 21.5% | |

| high | 92 | 0.1% |

loan_status

Categorical

| Distinct count | 2 |

|---|---|

| Unique (%) | 0.0% |

| Missing (%) | 0.0% |

| Missing (n) | 0 |

| Fully Paid | |

|---|---|

| Charged Off | 21392 |

| Value | Count | Frequency (%) | |

| Fully Paid | 151353 | 87.6% | |

| Charged Off | 21392 | 12.4% |

percent_bc_gt_75

Numeric

| Distinct count | 135 |

|---|---|

| Unique (%) | 0.1% |

| Missing (%) | 21.0% |

| Missing (n) | 36346 |

| Infinite (%) | 0.0% |

| Infinite (n) | 0 |

| Mean | 52.646 |

|---|---|

| Minimum | 0 |

| Maximum | 100 |

| Zeros (%) | 12.5% |

Quantile statistics

| Minimum | 0 |

|---|---|

| 5-th percentile | 0 |

| Q1 | 25 |

| Median | 50 |

| Q3 | 80 |

| 95-th percentile | 100 |

| Maximum | 100 |

| Range | 100 |

| Interquartile range | 55 |

Descriptive statistics

| Standard deviation | 34.436 |

|---|---|

| Coef of variation | 0.6541 |

| Kurtosis | -1.2091 |

| Mean | 52.646 |

| MAD | 29.443 |

| Skewness | -0.08618 |

| Sum | 7180800 |

| Variance | 1185.8 |

| Memory size | 1.3 MiB |

| Value | Count | Frequency (%) | |

| 100.0 | 28569 | 16.5% | |

| 0.0 | 21592 | 12.5% | |

| 50.0 | 16685 | 9.7% | |

| 66.7 | 11432 | 6.6% | |

| 33.3 | 9277 | 5.4% | |

| 75.0 | 7375 | 4.3% | |

| 25.0 | 5676 | 3.3% | |

| 60.0 | 4310 | 2.5% | |

| 40.0 | 4208 | 2.4% | |

| 80.0 | 4152 | 2.4% | |

| Other values (124) | 23123 | 13.4% | |

| (Missing) | 36346 | 21.0% |

Minimum 5 values

| Value | Count | Frequency (%) | |

| 0.0 | 21592 | 12.5% | |

| 0.2 | 3 | 0.0% | |

| 0.25 | 2 | 0.0% | |

| 0.29 | 1 | 0.0% | |

| 0.33 | 17 | 0.0% |

Maximum 5 values

| Value | Count | Frequency (%) | |

| 93.3 | 3 | 0.0% | |

| 93.7 | 3 | 0.0% | |

| 94.1 | 2 | 0.0% | |

| 94.4 | 1 | 0.0% | |

| 100.0 | 28569 | 16.5% |

purpose

Categorical

| Distinct count | 14 |

|---|---|

| Unique (%) | 0.0% |

| Missing (%) | 0.0% |

| Missing (n) | 0 |

| debt_consolidation | |

|---|---|

| credit_card | |

| other | 10214 |

| Other values (11) |

| Value | Count | Frequency (%) | |

| debt_consolidation | 94874 | 54.9% | |

| credit_card | 39270 | 22.7% | |

| other | 10214 | 5.9% | |

| home_improvement | 9817 | 5.7% | |

| major_purchase | 4690 | 2.7% | |

| small_business | 3342 | 1.9% | |

| car | 2616 | 1.5% | |

| wedding | 1892 | 1.1% | |

| medical | 1877 | 1.1% | |

| moving | 1427 | 0.8% | |

| Other values (4) | 2726 | 1.6% |

revol_util

Numeric

| Distinct count | 1063 |

|---|---|

| Unique (%) | 0.6% |

| Missing (%) | 0.1% |

| Missing (n) | 144 |

| Infinite (%) | 0.0% |

| Infinite (n) | 0 |

| Mean | 55.829 |

|---|---|

| Minimum | 0 |

| Maximum | 140.4 |

| Zeros (%) | 0.7% |

Quantile statistics

| Minimum | 0 |

|---|---|

| 5-th percentile | 11 |

| Q1 | 38.6 |

| Median | 57.9 |

| Q3 | 75.1 |

| 95-th percentile | 92.2 |

| Maximum | 140.4 |

| Range | 140.4 |

| Interquartile range | 36.5 |

Descriptive statistics

| Standard deviation | 24.413 |

|---|---|

| Coef of variation | 0.43729 |

| Kurtosis | -0.68504 |

| Mean | 55.829 |

| MAD | 20.246 |

| Skewness | -0.32716 |

| Sum | 9636100 |

| Variance | 596.01 |

| Memory size | 1.3 MiB |

| Value | Count | Frequency (%) | |

| 0.0 | 1265 | 0.7% | |

| 64.6 | 301 | 0.2% | |

| 61.5 | 296 | 0.2% | |

| 66.5 | 293 | 0.2% | |

| 63.0 | 291 | 0.2% | |

| 61.3 | 289 | 0.2% | |

| 58.3 | 287 | 0.2% | |

| 66.6 | 282 | 0.2% | |

| 55.9 | 281 | 0.2% | |

| 62.6 | 280 | 0.2% | |

| Other values (1052) | 168736 | 97.7% |

Minimum 5 values

| Value | Count | Frequency (%) | |

| 0.0 | 1265 | 0.7% | |

| 0.1 | 118 | 0.1% | |

| 0.2 | 103 | 0.1% | |

| 0.3 | 89 | 0.1% | |

| 0.4 | 76 | 0.0% |

Maximum 5 values

| Value | Count | Frequency (%) | |

| 120.2 | 2 | 0.0% | |

| 122.5 | 1 | 0.0% | |

| 127.6 | 1 | 0.0% | |

| 128.1 | 1 | 0.0% | |

| 140.4 | 1 | 0.0% |

Sample

Predictive Modeling¶

def to_xy(dataset):

y = dataset.pop('loan_status').cat.codes

X = pd.get_dummies(dataset, drop_first=True)

return X, y

Initializing Train/Test Sets¶

Shuffle and Split Data¶

Let’s split the data (both features and their labels) into training and test sets. 80% of the data will be used for training and 20% for testing.

Run the code cell below to perform this split.

X, y = load_and_preprocess_data().pipe(to_xy)

split_data = train_test_split(X, y, test_size=0.20, stratify=y, random_state=11)

X_train, X_test, y_train, y_test = split_data

train_test_sets = dict(

zip(['X_train', 'X_test', 'y_train', 'y_test'], [*split_data]))

(pd.DataFrame(

data={'Observations (#)': [X_train.shape[0], X_test.shape[0]],

'Percent (%)': ['80%', '20%'],

'Features (#)': [X_train.shape[1], X_test.shape[1]]},

index=['Training', 'Test'])

[['Percent (%)', 'Features (#)', 'Observations (#)']])

| Percent (%) | Features (#) | Observations (#) | |

|---|---|---|---|

| Training | 80% | 34 | 138196 |

| Test | 20% | 34 | 34549 |

Classification Models¶

Naive Predictor (Baseline)¶

dummy_model = LearningModel(

'Naive Predictor - Baseline', Pipeline([

('imp', Imputer(strategy='median')),

('clf', DummyClassifier(strategy='constant', constant=0))]))

dummy_model.fit_and_predict(**train_test_sets)

model_evals = eval_db(dummy_model.eval_report)

Decision Tree Classifier¶

tree_model = LearningModel(

'Decision Tree Classifier', Pipeline([

('imp', Imputer(strategy='median')),

('clf', DecisionTreeClassifier(class_weight='balanced', random_state=11))]))

tree_model.fit_and_predict(**train_test_sets)

tree_model.display_evaluation()

model_evals = eval_db(model_evals, tree_model.eval_report)

| FitTime | Accuracy | FBeta | F1 | AUC | |

|---|---|---|---|---|---|

| Decision Tree Classifier | 2.0 | 0.78558 | 0.156742 | 0.154531 | 0.516244 |

precision recall f1-score support

0 0.88 0.87 0.88 30271

1 0.15 0.16 0.15 4278

avg / total 0.79 0.79 0.79 34549

Random Forest Classifier¶

rf_model = LearningModel(

'Random Forest Classifier', Pipeline([

('imp', Imputer(strategy='median')),

('clf', RandomForestClassifier(

class_weight='balanced_subsample', random_state=11))]))

rf_model.fit_and_predict(**train_test_sets)

rf_model.display_evaluation()

model_evals = eval_db(model_evals, rf_model.eval_report)

| FitTime | Accuracy | FBeta | F1 | AUC | |

|---|---|---|---|---|---|

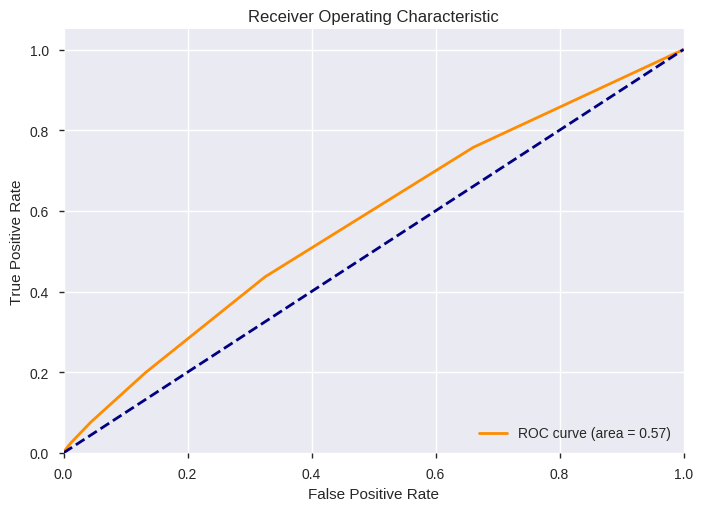

| Random Forest Classifier | 2.0 | 0.874671 | 0.008998 | 0.014117 | 0.573608 |

precision recall f1-score support

0 0.88 1.00 0.93 30271

1 0.27 0.01 0.01 4278

avg / total 0.80 0.87 0.82 34549

Blagging Classifier¶

Base Estimator -> RF¶

blagging_pipeline = Pipeline([

('imp', Imputer(strategy='median')),

('clf', BlaggingClassifier(

random_state=11, n_jobs=-1,

base_estimator=RandomForestClassifier(

class_weight='balanced_subsample', random_state=11)))])

blagging_model = LearningModel('Blagging Classifier (RF)', blagging_pipeline)

blagging_model.fit_and_predict(**train_test_sets)

blagging_model.display_evaluation()

model_evals = eval_db(model_evals, blagging_model.eval_report)

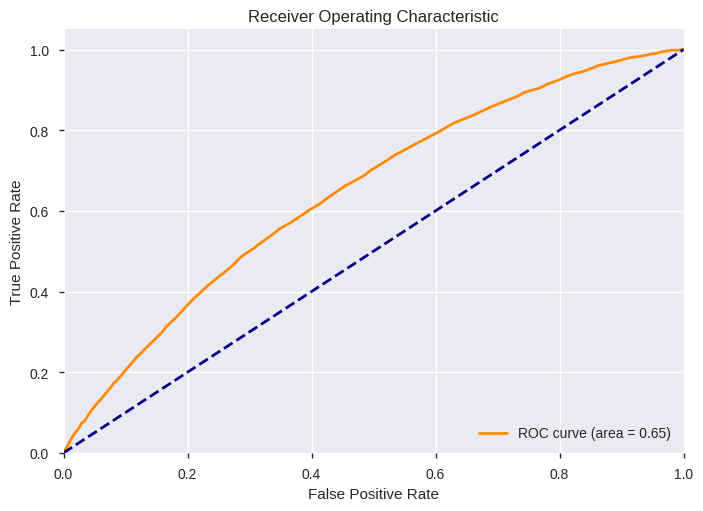

| FitTime | Accuracy | FBeta | F1 | AUC | |

|---|---|---|---|---|---|

| Blagging Classifier (RF) | 2.0 | 0.719181 | 0.344518 | 0.270746 | 0.645877 |

precision recall f1-score support

0 0.90 0.76 0.83 30271

1 0.20 0.42 0.27 4278

avg / total 0.82 0.72 0.76 34549

Base Estimator -> ExtraTrees¶

blagging_clf = BlaggingClassifier(

random_state=11, n_jobs=-1,

base_estimator=ExtraTreesClassifier(

criterion='entropy', class_weight='balanced_subsample',

max_features=None, n_estimators=60, random_state=11))

blagging_model = LearningModel(

'Blagging Classifier (Extra Trees)', Pipeline([

('imp', Imputer(strategy='median')),

('clf', blagging_clf)]))

blagging_model.fit_and_predict(**train_test_sets)

blagging_model.display_evaluation()

model_evals = eval_db(model_evals, blagging_model.eval_report)

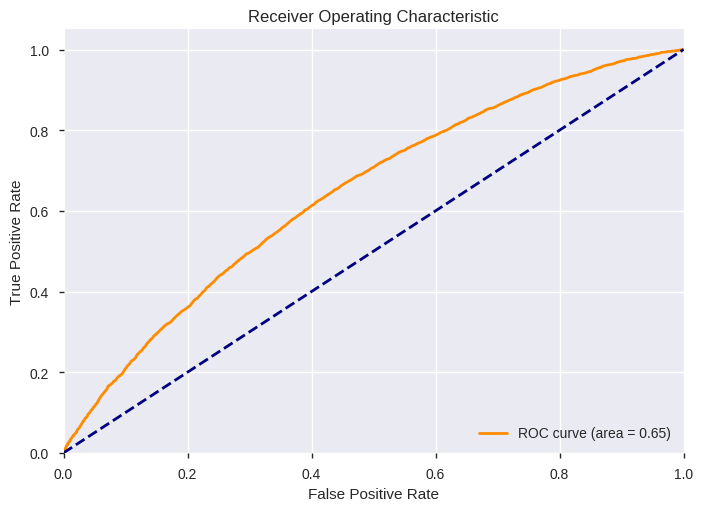

| FitTime | Accuracy | FBeta | F1 | AUC | |

|---|---|---|---|---|---|

| Blagging Classifier (Extra Trees) | 19.0 | 0.749718 | 0.309224 | 0.259611 | 0.645899 |

precision recall f1-score support

0 0.90 0.81 0.85 30271

1 0.20 0.35 0.26 4278

avg / total 0.81 0.75 0.78 34549

Evaluating Model Performance¶

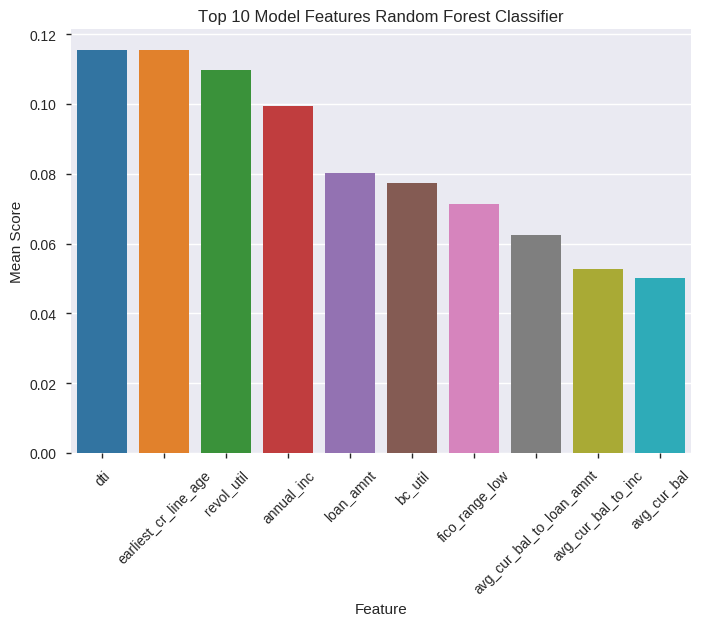

Feature Importance (via RandomForestClassifier)¶

rf_top_features = LearningModel('Random Forest Classifier',

Pipeline([('imp', Imputer(strategy='median')),

('clf', RandomForestClassifier(max_features=None,

class_weight='balanced_subsample', random_state=11))]))

rf_top_features.fit_and_predict(**train_test_sets)

rf_top_features.display_top_features(top_n=15)

| Feature | Score | |

|---|---|---|

| 1 | dti | 0.115602 |

| 2 | earliest_cr_line_age | 0.115381 |

| 3 | revol_util | 0.109714 |

| 4 | annual_inc | 0.099535 |

| 5 | loan_amnt | 0.080153 |

| 6 | bc_util | 0.077465 |

| 7 | fico_range_low | 0.071342 |

| 8 | avg_cur_bal_to_loan_amnt | 0.062594 |

| 9 | avg_cur_bal_to_inc | 0.052817 |

| 10 | avg_cur_bal | 0.050275 |

| 11 | emp_length | 0.047003 |

| 12 | percent_bc_gt_75 | 0.034591 |

| 13 | home_ownership_RENT | 0.009037 |

| 14 | purpose_credit_card | 0.008536 |

| 15 | purpose_debt_consolidation | 0.007986 |

rf_top_features.plot_top_features(top_n=10)

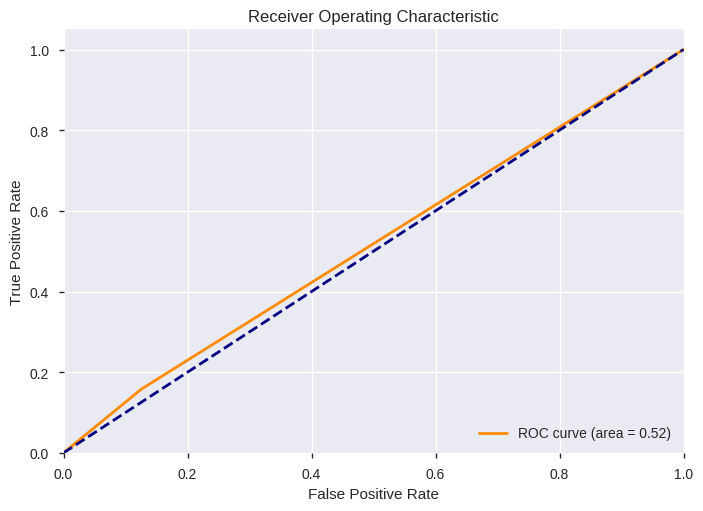

Model Selection¶

Comparative Analysis¶

display(model_evals)

| FitTime | Accuracy | FBeta | F1 | AUC | |

|---|---|---|---|---|---|

| Naive Predictor - Baseline | 0.0 | 0.876176 | 0.000000 | 0.000000 | 0.500000 |

| Decision Tree Classifier | 2.0 | 0.785580 | 0.156742 | 0.154531 | 0.516244 |

| Random Forest Classifier | 2.0 | 0.874671 | 0.008998 | 0.014117 | 0.573608 |

| Blagging Classifier (RF) | 2.0 | 0.719181 | 0.344518 | 0.270746 | 0.645877 |

| Blagging Classifier (Extra Trees) | 19.0 | 0.749718 | 0.309224 | 0.259611 | 0.645899 |

Optimal Model¶

blagging_model = LearningModel('Blagging Classifier (Extra Trees)',

Pipeline([('imp', Imputer(strategy='median')),

('clf', BlaggingClassifier(

base_estimator=ExtraTreesClassifier(

criterion='entropy', class_weight='balanced_subsample',

max_features=None, n_estimators=60, random_state=11),

random_state=11, n_jobs=-1))]))

blagging_model.fit_and_predict(**train_test_sets)

Optimizing Hyperparameters¶

ToDo: Perform GridSearch…¶

Results:¶

(pd.DataFrame(data={'Benchmark Predictor': [0.7899, 0.1603, 0.5203],

'Unoptimized Model': [0.7499, 0.2602, 0.6463],

'Optimized Model': ['', '', '']},

index=['Accuracy Score', 'F1-score', 'AUC'])

[['Benchmark Predictor', 'Unoptimized Model', 'Optimized Model']])

| Benchmark Predictor | Unoptimized Model | Optimized Model | |

|---|---|---|---|

| Accuracy Score | 0.7899 | 0.7499 | |

| F1-score | 0.1603 | 0.2602 | |

| AUC | 0.5203 | 0.6463 |